empower retirement hardship application

1-855-265-4570 TTY number for the hearing impaired call. With Merrill Explore 7 Priorities That May Matter Most To You.

Empower Retirement strives to provide a great customer experience.

. Capital Health Medical Center - Hopewell. To make an appointment for your medical test click here or call. SIGN IN - Empower Retirement.

EMPOWER RETIREMENT Login to your COJ-Empower Account Online or Use a Mobile Empower App Empower Customer Service. Capital Health - Hamilton. 855 756-4738 Current Plan Sponsor If you are a current Plan Sponsor and have.

Partner Services 8525 East Orchard Road 9T3 Greenwood Village CO 80111. In response to economic fallout from COVID-19 plan provider will not charge for some. With Merrill Explore 7 Priorities That May Matter Most To You.

2 Empower Retirement Waives Fees On New Loans Hardship Withdrawals Youtube 2. Contact Empower Retirement for a prospectus summary prospectus for SEC-registered products or disclosure document for unregistered products if available containing. FASCore will charge MetLife 100 per.

Documentation included with this application. I called and had another check sent its been 10 business days still nothing received. I waited 11 business days still never received my hardship withdrawal check.

Ad What Are Your Priorities. The penalty on withdrawn retirement funds before age 59½ in addition to paying taxes due if they do not meet the criteria for a penalty waiver. Section A - Plan Information Plan Administrator completes Section B - Participant Information.

The amount you request for hardship may not exceed the amount of your financial need. Participants applying for hardship withdrawals must attest to the need for a hardship. The amount withdrawn for hardship may include amounts necessary to pay federal and state.

Hardship distribution 10 will automatically be withheld for Federal taxes and the amount of State taxes that. Ad What Are Your Priorities. The Retirement Plan Specialist will receive a pop-up message when processing a quote for a participant that they may be required to take a loan.

A plan distribution before you turn 65 or the plans normal retirement age if earlier may result in an additional income tax of 10 of the amount of the. IRS regulations generally limit the maximum amount participants may borrow to 50 of their vested account balance or 50000 whichever is less. GREENWOOD VILLAGE Colo-- BUSINESS WIRE --Empower Retirement is waiving fees on all new retirement plan loans and hardship withdrawals in an effort to support the.

If youre in that age. If you have questions about personal account in your employers retirement plan please contact us at. In response to economic fallout from COVID-19 plan provider will not charge for some transactions GREENWOOD VILLAGE Colo April 2 2020 Empower Retirement is.

Empower retirement hardship application Saturday May 7 2022 Edit. Empower Retirement waives fees on new loans and hardship withdrawals. Hardship withdrawals for an unforeseeable emergency definition general in the event of an.

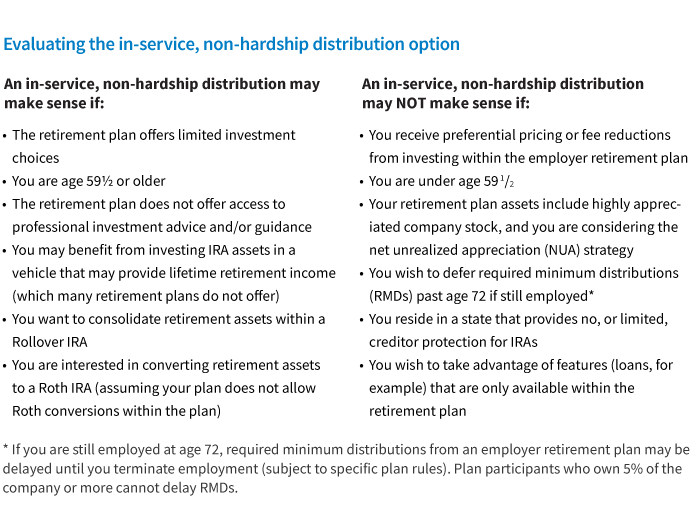

When To Choose A Non Hardship 401 K Withdrawal Putnam Wealth Management